What a difference a shitty year makes!?!?!

Remember when we asked whether Biden or Trump would win the 2024 election? At the time of our last survey, 70% of our smartest friends in healthcare were anticipating the stock market would be booming at the end of 2024 and even more were optimistic about the health tech IPO market. And you were RIGHT… for about a minute in Q4 ‘24, and then we entered a pandemic of chaos and uncertainty. You also correctly anticipated the continued meteoric rise of GLP-1s, which became so popular that we saw a temporary shortage. Just wait until multiple orals come out (Eli Lilly’s data on orforglipron looks blockbuster great) – between these and crypto, the Budweiser Clydesdales will get priced out of Super Bowl ads for the next decade.

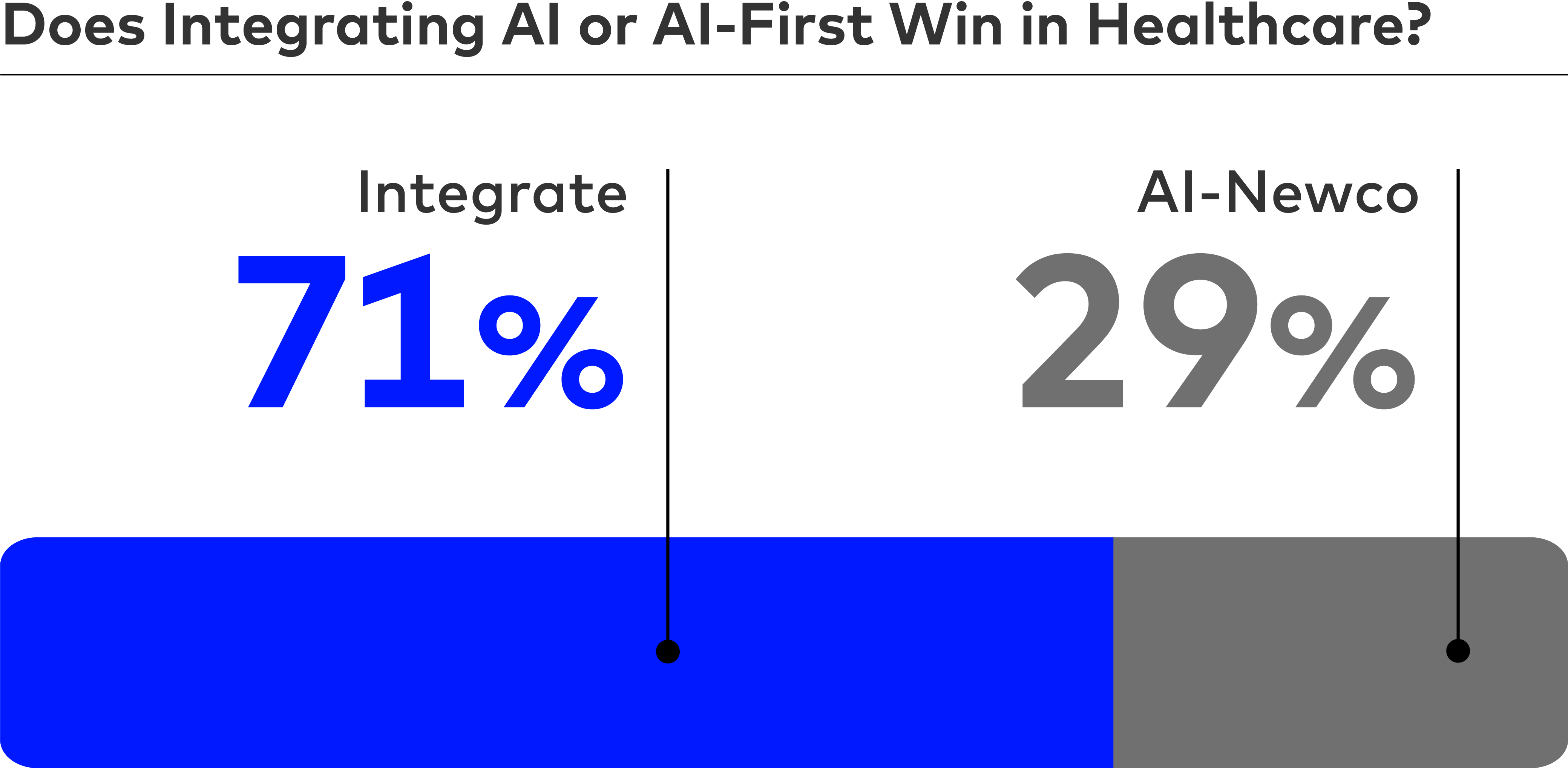

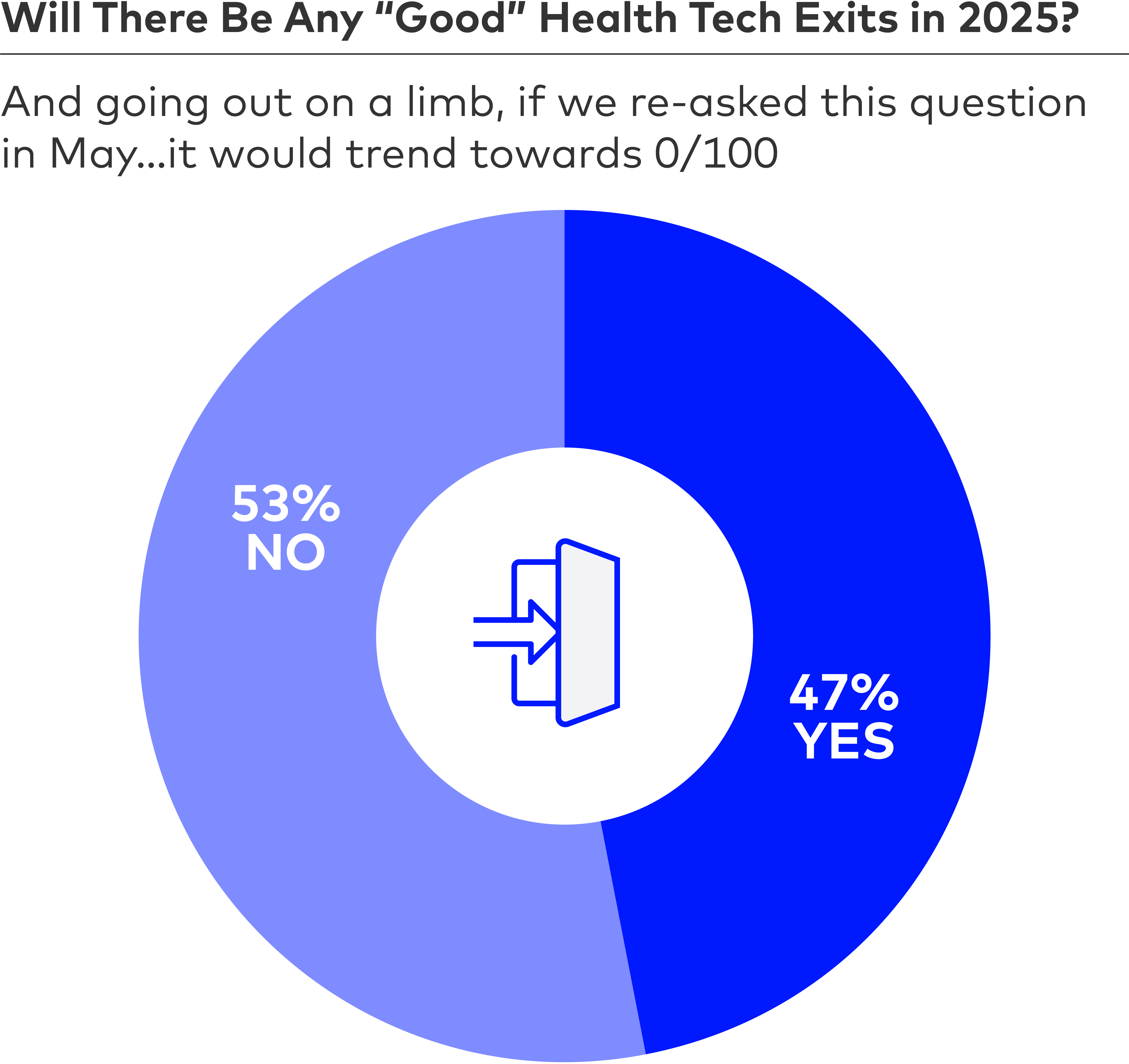

This year, optimism is in the rearview and the craziness remains. You’re split down the middle on whether we’ll see any good health tech M&A, though we can’t figure out why, IPOs seem squarely off the 2025 table, and you’re holding your breath to see what both tariffs and RFK look like by late summer. For the 29% who predicted that tariffs will have come and gone by the end of the year, one might vote differently today – or maybe not … that is how deeply uncertainty pervades the current environment. We are, collectively, more confident that integrating AI into existing businesses will lower administrative costs.

As always, we are grateful to the hundreds of healthcare experts who take the time to share their views and opinions with us every year. If we had to sum up what they think: our universe is a hot mess … how long will it last? Our full commentary on the most interesting findings from this year’s survey, followed by the full results, can be found below.

AI OPTIMISM

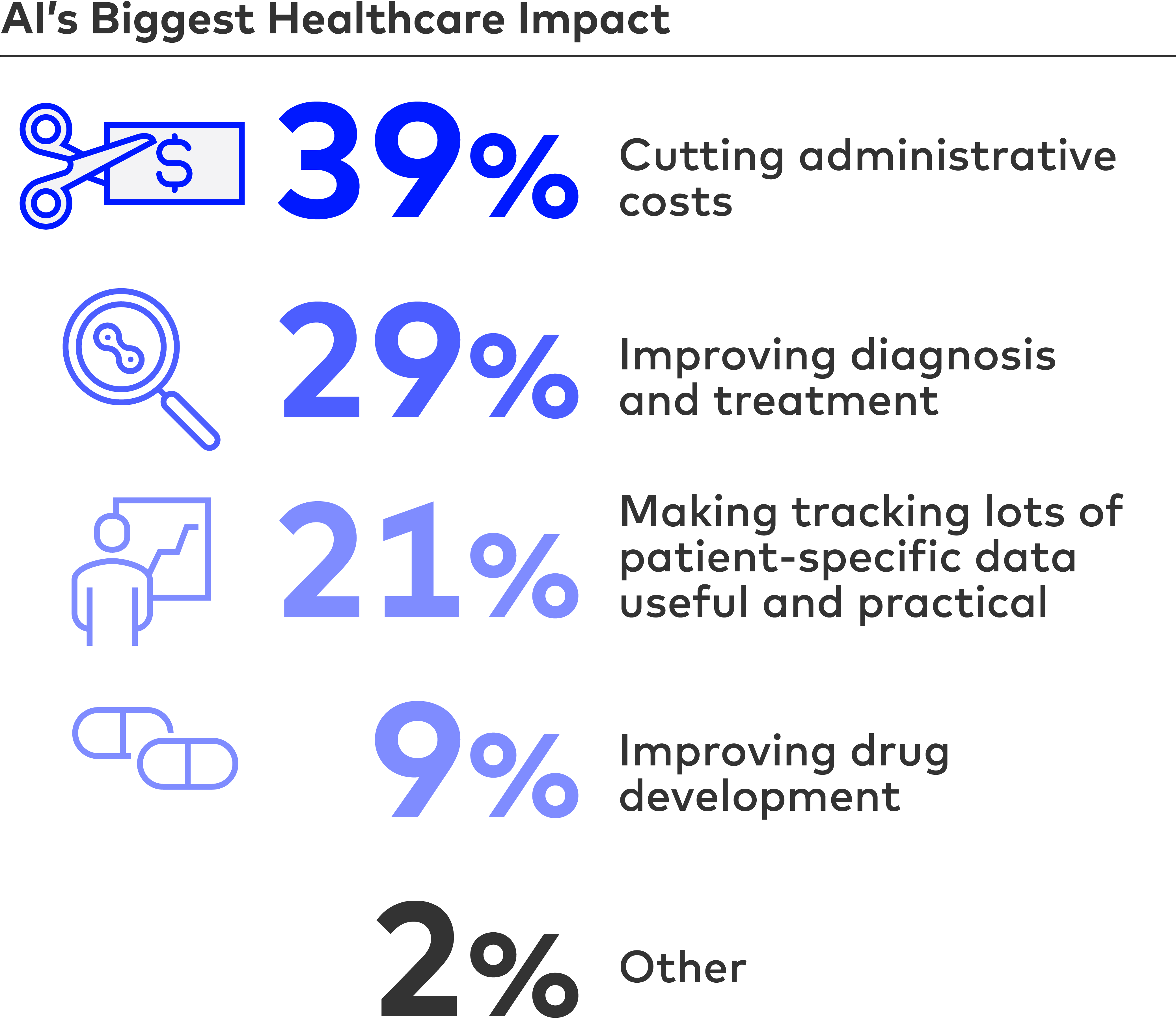

Everyone’s talking about AI and healthcare is no exception. It’s going to make us more productive, save us money, make us smarter and, ultimately, help us deliver better care. For several years now, the enthusiasm around AI has been strong among our respondents, but excitement for clinical applications are only more recently gathering steam.

INTEGRATING AI

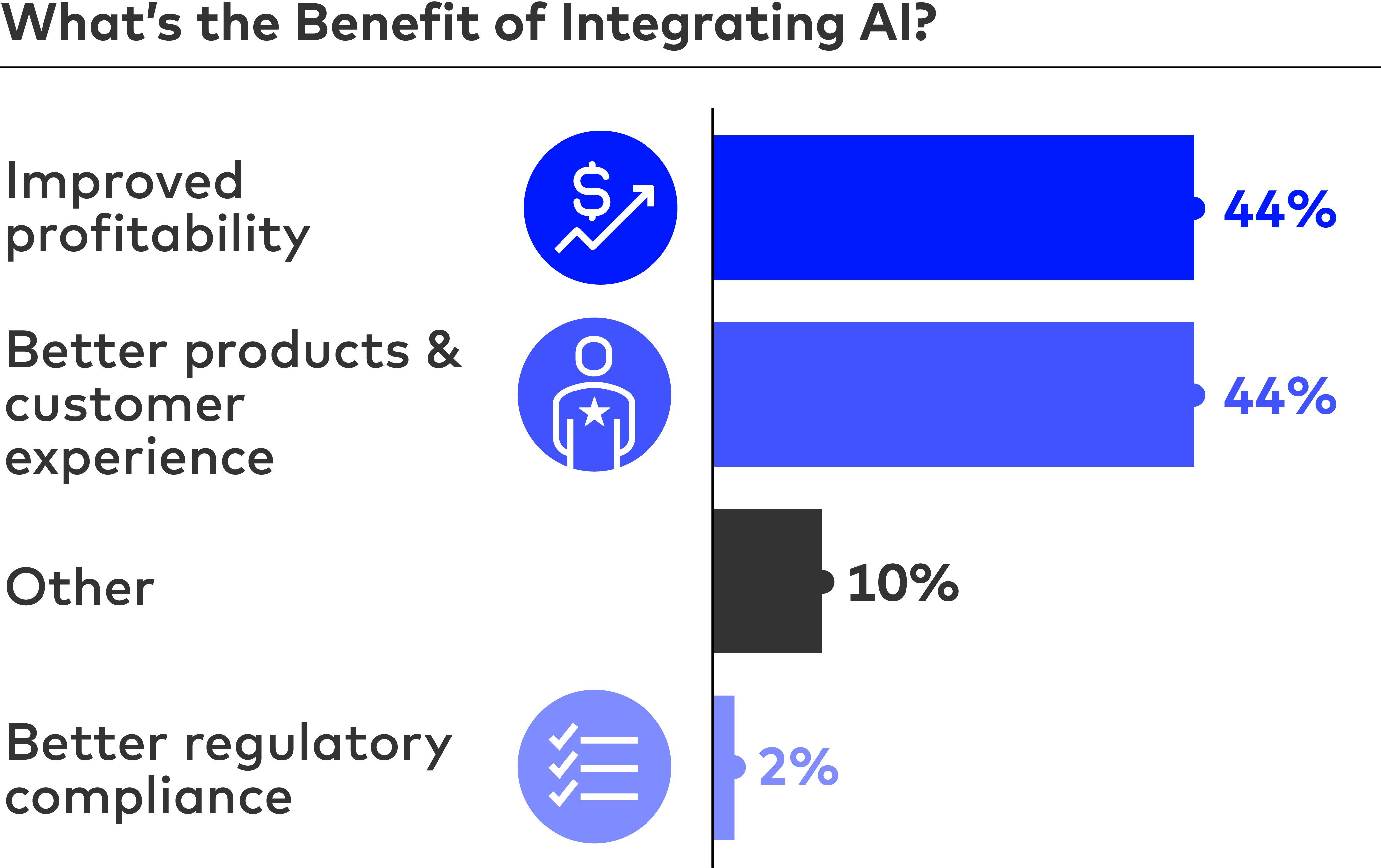

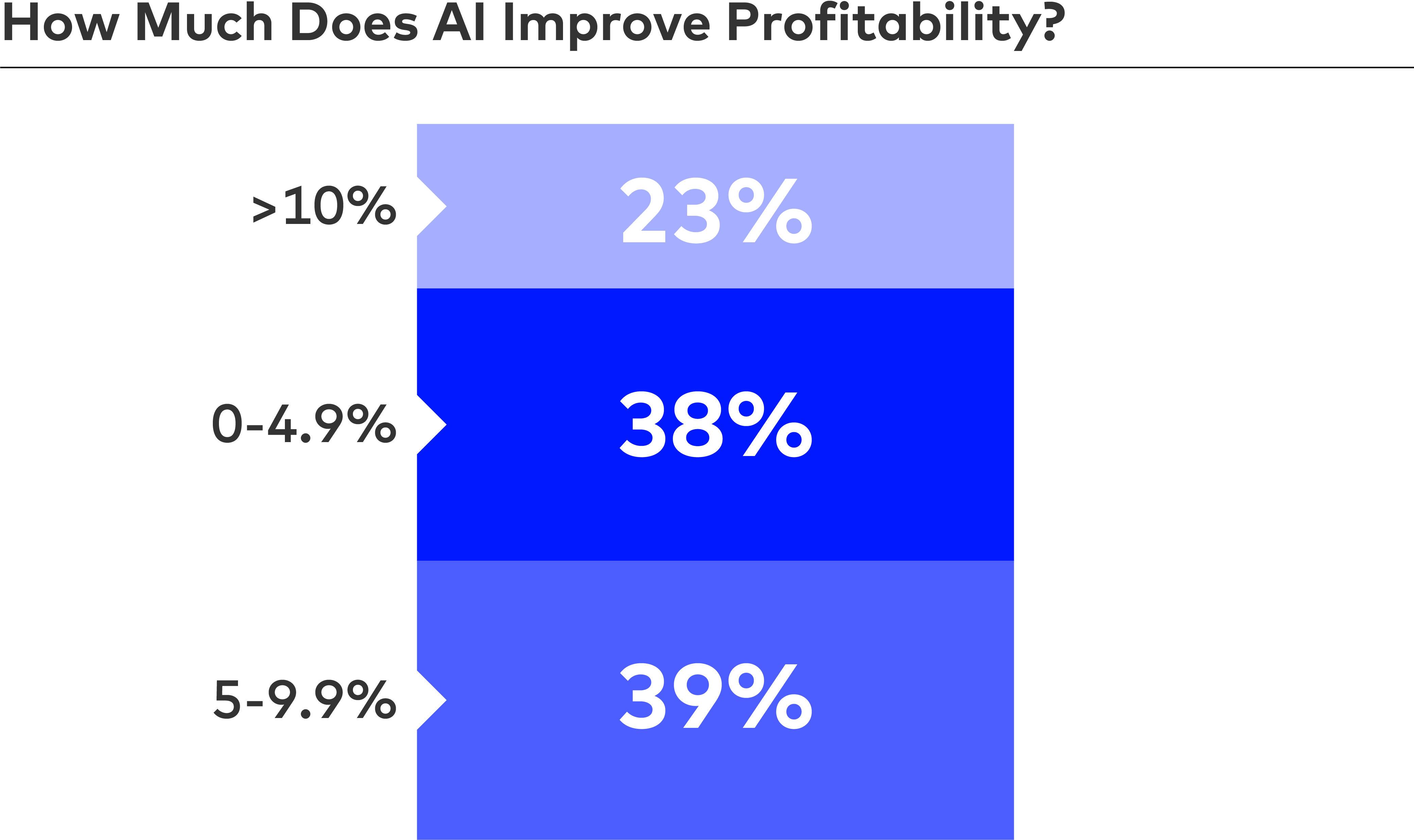

We share the view of the clear majority who think integrating AI into an existing business is, at least currently, superior to building an AI specific business (point?) solution. Notably, nearly two thirds of you think AI will add 5+ points to net income. For low margin services businesses, this is a giant increase and therefore a material valuation multiplier.

AI Looks Like Healthcare’s Productivity Rosetta Stone

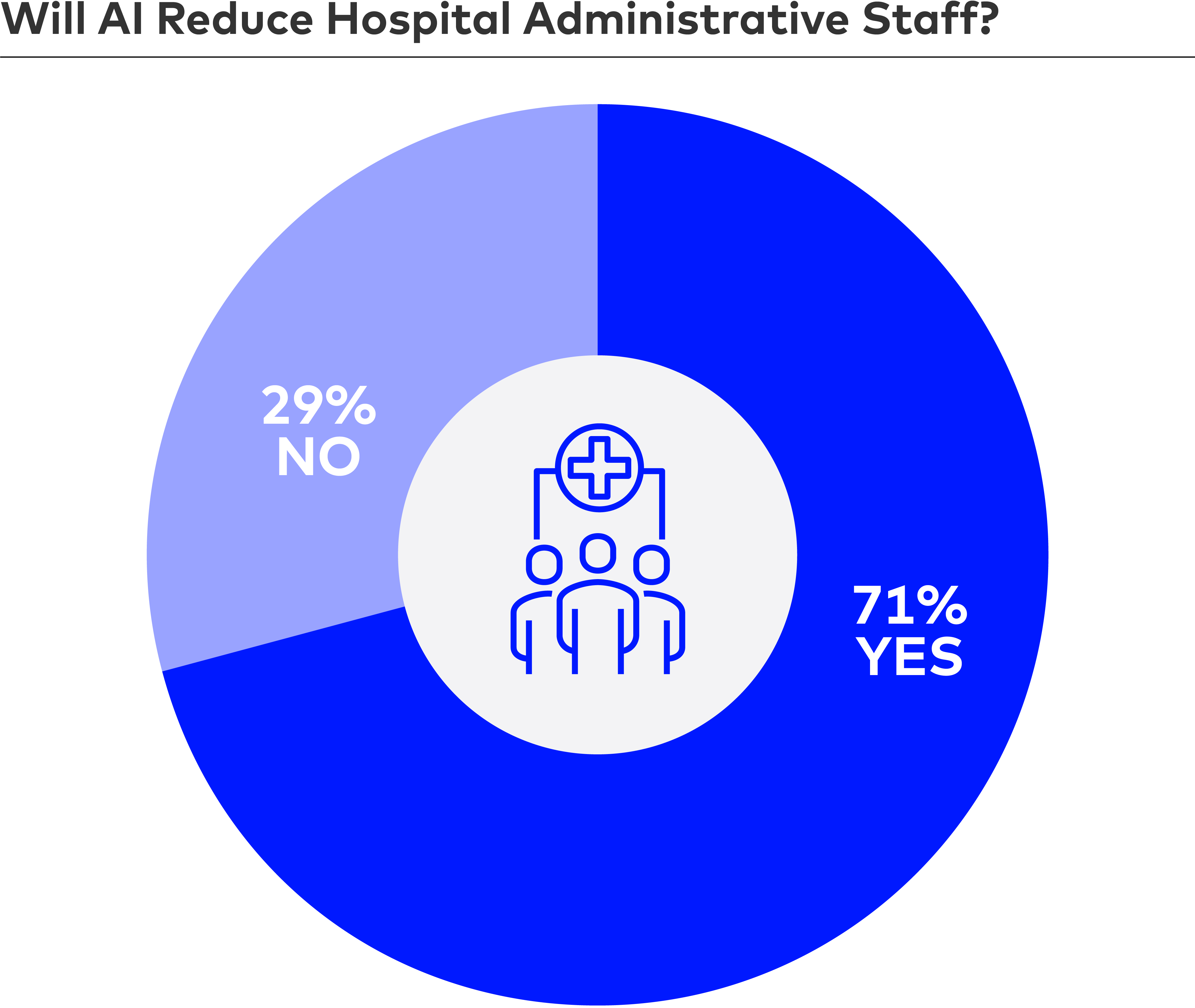

Since the Bureau of Labor Statistics has tracked the data, healthcare and higher education duke it out for the sectors with the lowest labor productivity. You share our view that AI has the potential to meaningfully reduce administrative staff and costs at hospitals and payors for the first time ever (although 29% of you still think nothing can slow admin hiring). Not to mention the productivity being realized by physicians using AI scribes (we have never heard of a doctor going back to typing or dictating).

STARTUP UNCERTAINTY

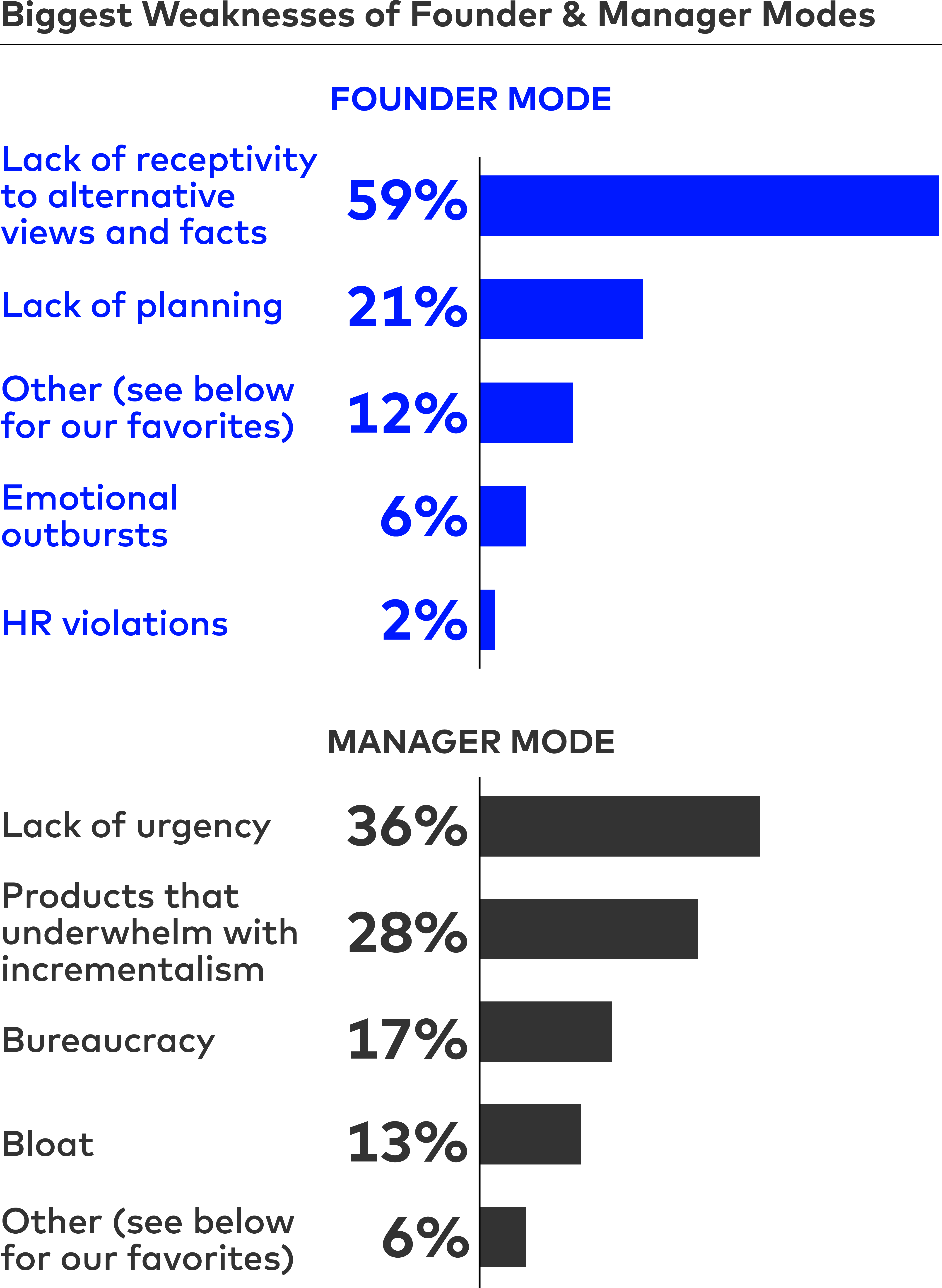

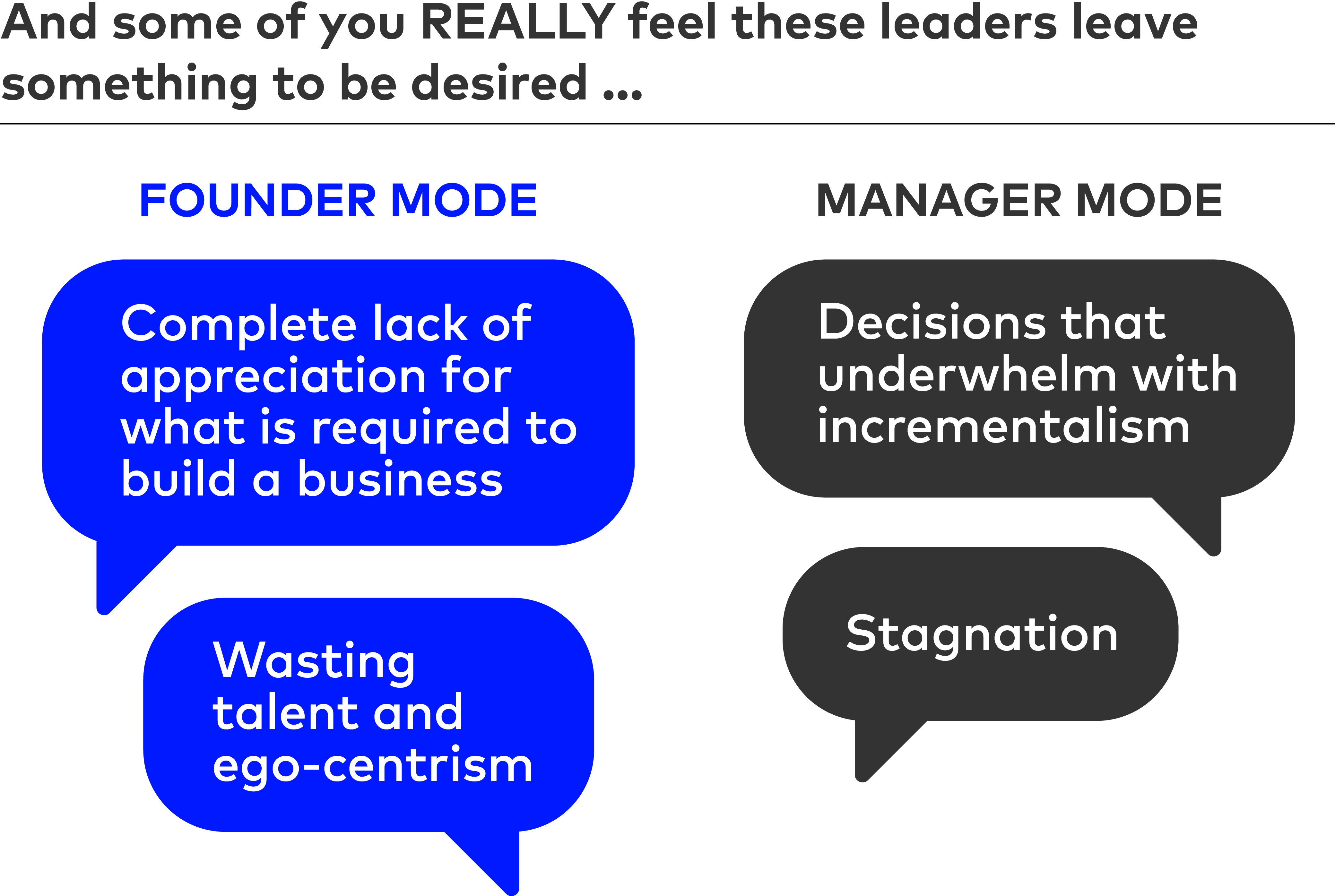

What this year looks like for startups is a question mark (at best, and assuming you are not out of CBD gummies…). You’re unsure if we’ll see any M&A and think IPOs are likely off the table. And in considering “founder mode or manager mode,” you all are cynical of both.

Founder Mode, Manager Mode… Who’s the Fairest of Them All?

The answer to one of the year’s buzziest debates on leadership styles is – at least for the cliche issues – neither is categorically awesome and each has its pitfalls.

…But we were all hoping for lots of M&A and IPOs 🤷♀️

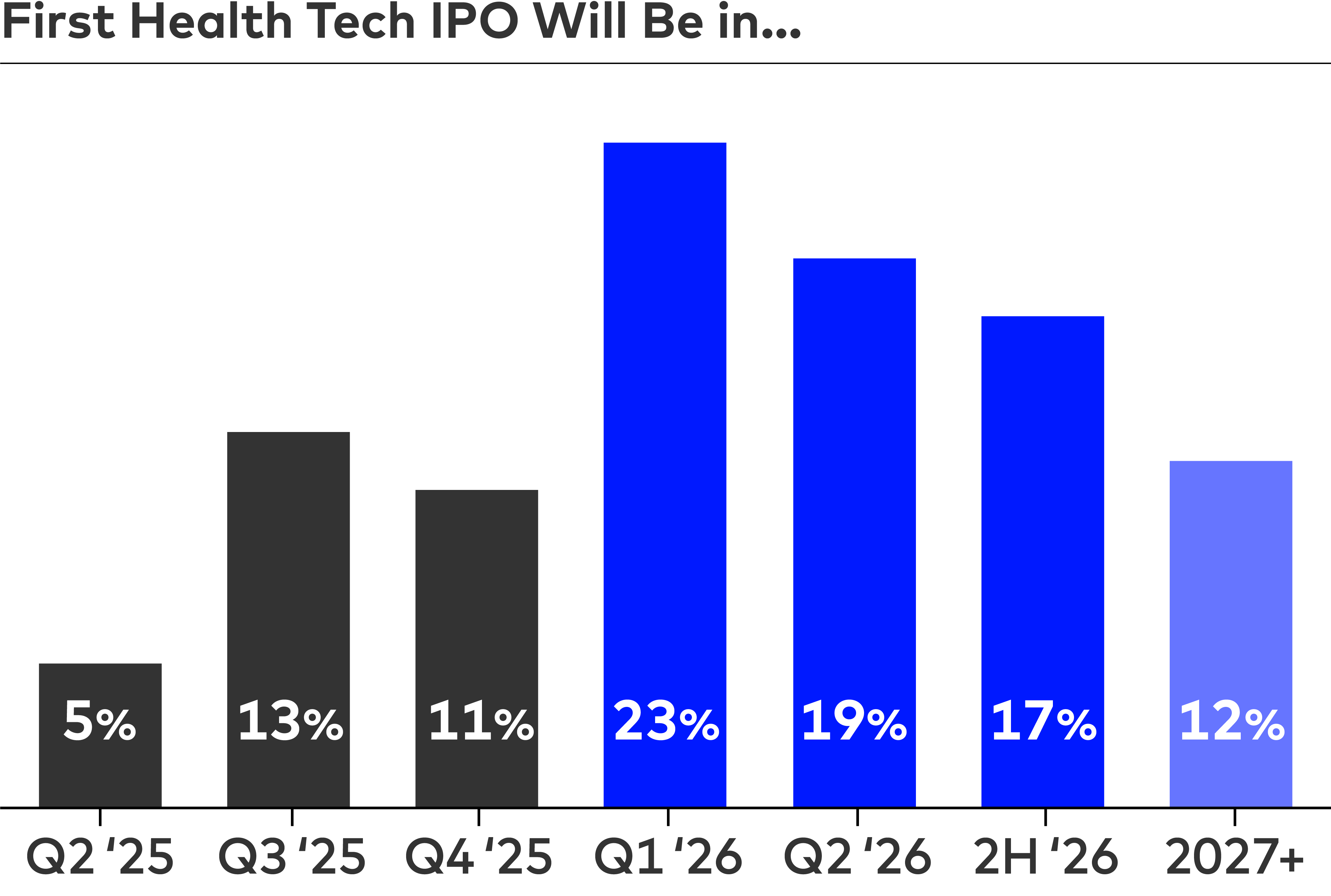

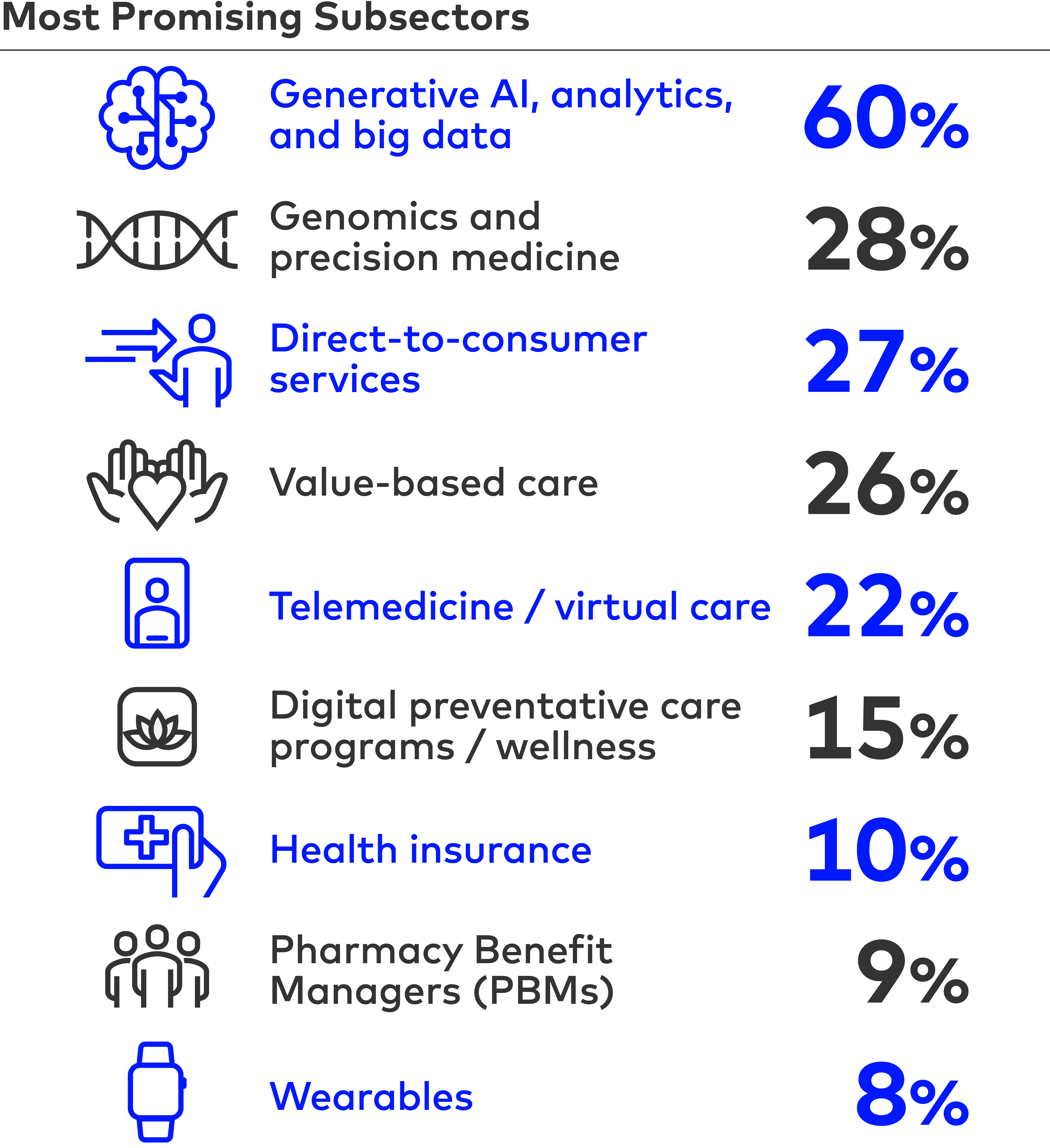

We’re in a moment of great uncertainty and there is, not surprisingly, a lack of confidence that we’ll see any “good” health tech deals. What companies or sectors might see an exit? When will we see our first IPO? People are pretty unsure on timing other than 2026 and are leaning towards high margin tech/AI businesses as the bellwether.

ECONOMIC PESSIMISM

Pessimism trumps optimism. Last year the glass was half full, but 2025 has already crushed your spirit. We’ve got tariffs and measles – yikes. Maybe we lose fluoride and NIH funding next (OK, they seem to be gone by the time of this publication…).

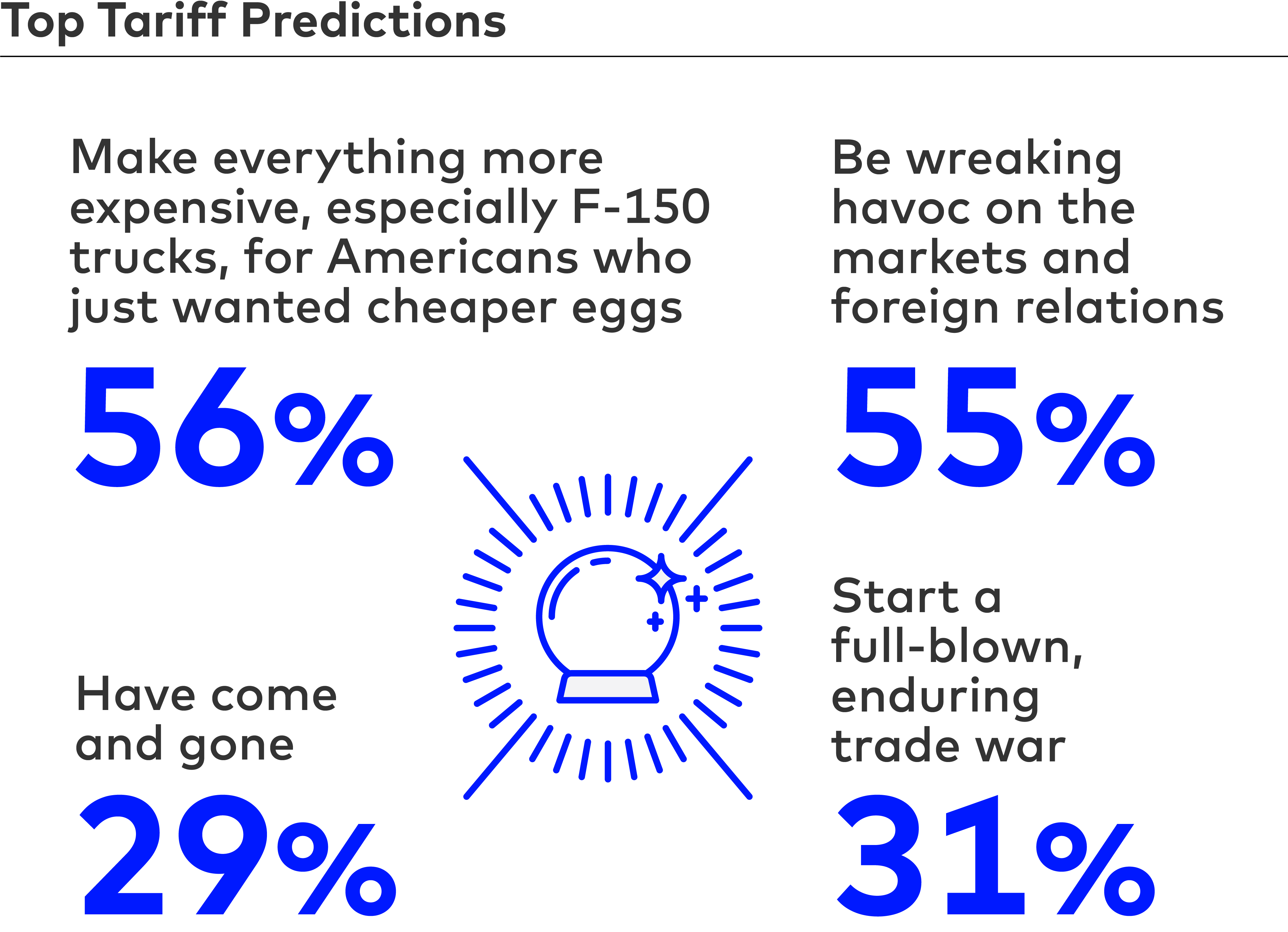

The T Word

You all agree we won’t be thriving under tariffs in 2025. Considering our survey went out before “Liberation Day,” the third who thought they would come and go, might reconsider today…

The Only Certainty is a Wild Ride

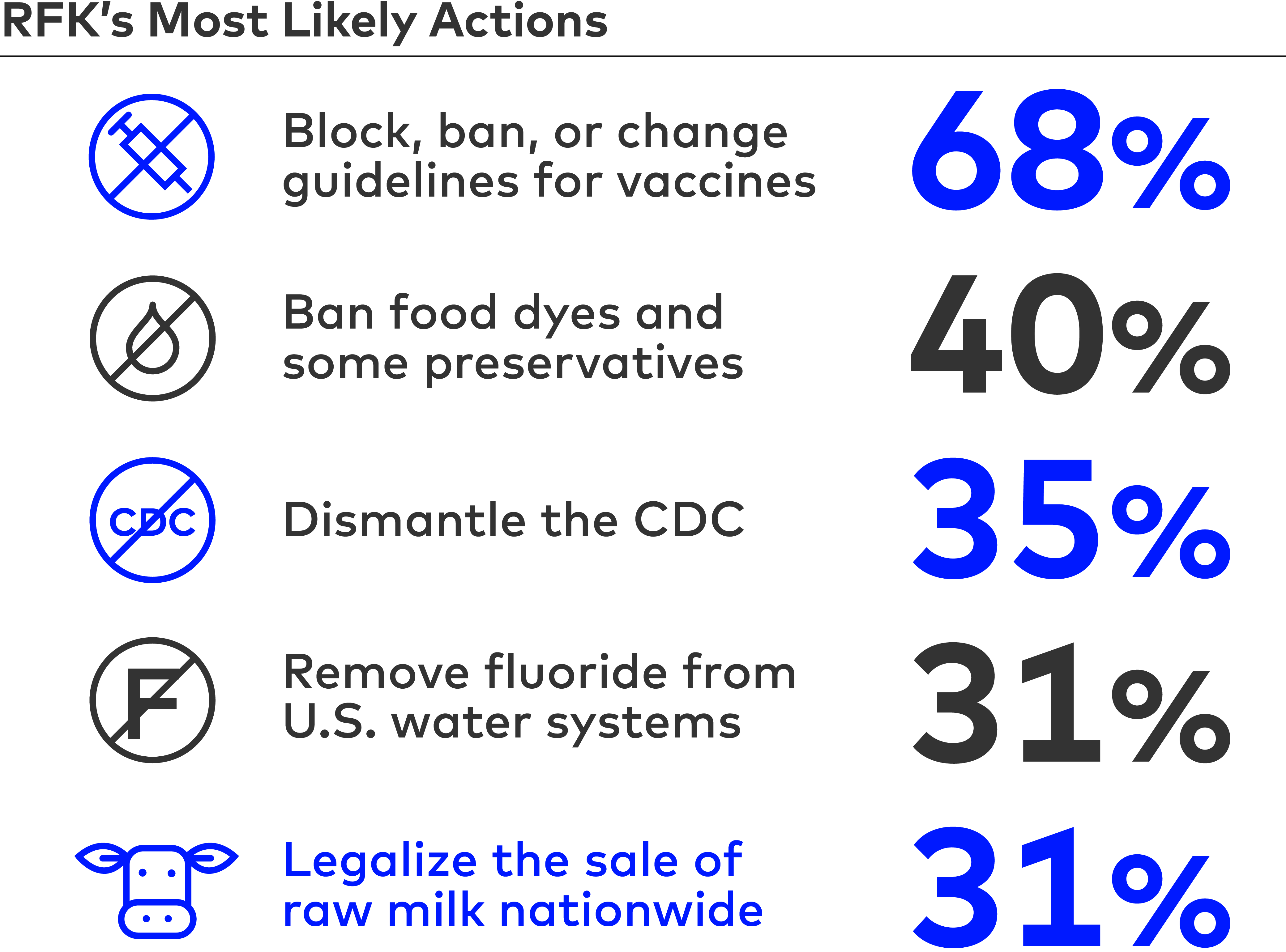

With fluoride out of Utah and Florida water and a measles outbreak, the one predictable thing about 2025 is that it’s unpredictable. And you all seem to agree that RFK has scary plans for us in the future.

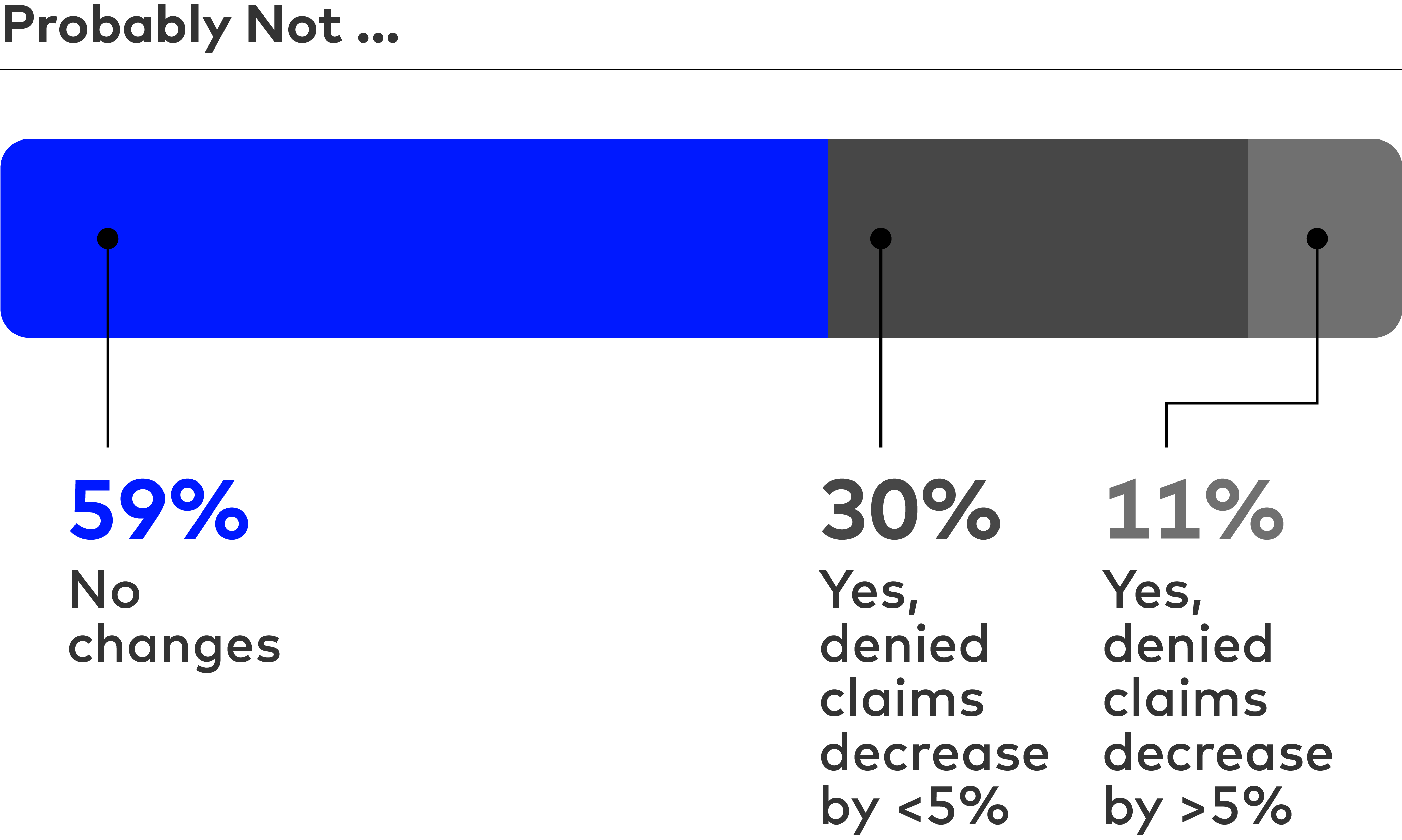

Claims Approval Process is Broken, But Fix It? Fat Chance.

In spite of the reaction to the assassination of UnitedHealthcare CEO Brian Thompson, and the conspicuous unpopularity of prior authorization requirements, will we see a decrease in denied claims this year?

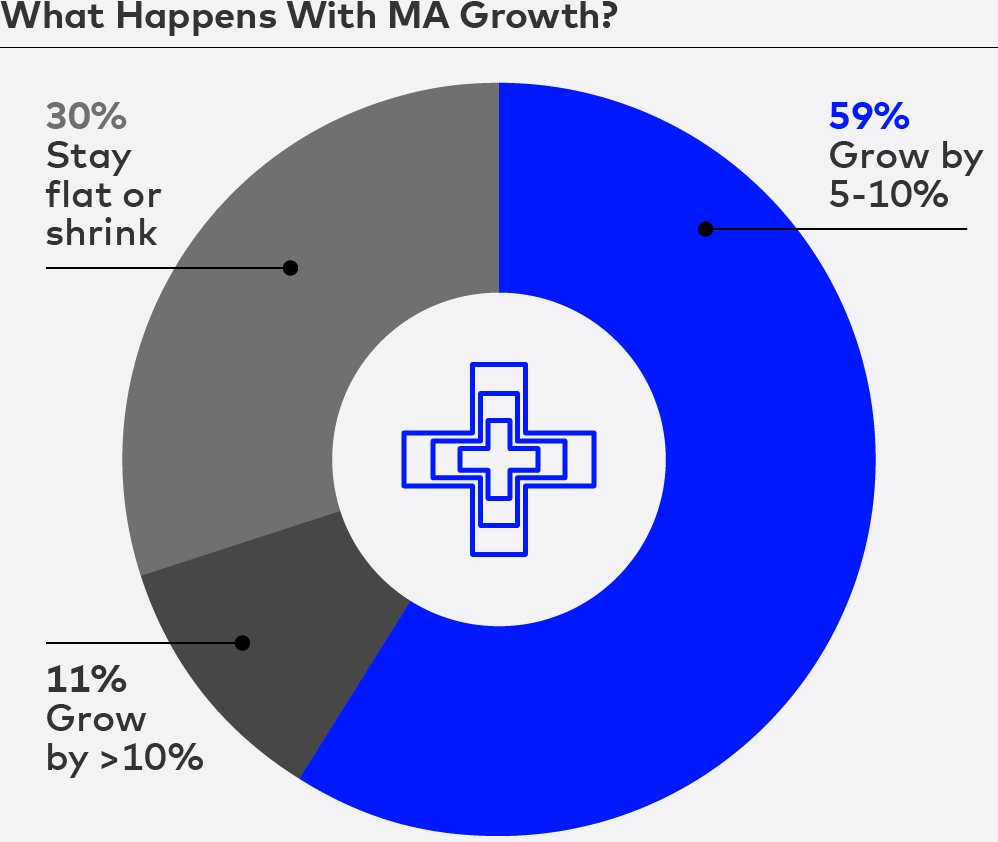

Medicare Advantage Grows, Modestly

We’re optimistic … but not too optimistic … about Medicare and Medicaid under Dr. Oz. Notably, this survey was done before the higher than expected MA rate notice of 5.06% on April 7th.

FULL SURVEY RESULTS

278 respondents from health tech startups, investors, high growth private companies, healthcare providers, healthcare payors, academics, life sciences and more conducted the survey between March 24, 2025 and April 8, 2025. If you would like to view the results of our previous surveys, you can find them here:

2024 Healthcare Prognosis

2023 Healthcare Prognosis

2022 Healthcare Prognosis

2021 Healthcare Prognosis

2020 Healthcare Prognosis

2019 Healthcare Prognosis

2018 Healthcare Prognosis

2017 Healthcare Prognosis

1

Will the winners in healthcare AI be companies that are customized healthcare AI-applications or existing healthcare businesses that integrate AI tools? (select one)

| 29% | Healthcare specific AI businesses |

| 71% | Integrating AI into an existing healthcare business |

2

For existing businesses that integrate AI, what will be the largest benefit? (select one)

| 44% | Improved profitability |

| 44% | Better products/customer experience |

| 2% | Better regulatory compliance |

| 10% | Other (please specify) |

3

If you selected improved profitability above, by how much will it improve? (select one)

| 38% | 0-4.9% to bottom line |

| 39% | 5-9.9% to bottom line |

| 23% | >10% to bottom line |

4

Will AI lead to a reduction in administrative staff at hospitals (for the first time ever excluding Covid years)? (select one)

| 71% | Yes |

| 29% | No |

5

The most dramatic impact of AI in healthcare will be (select one):

| 39% | Cutting administrative costs |

| 29% | Improving diagnosis and treatment |

| 9% | Improving drug development |

| 21% | Making tracking lots of patient-specific data useful and practical |

| 2% | Other (please specify) |

Founder Mode vs. Manager Mode became a meme in 2024. What is the greatest shortcoming you have observed with each mode of leadership?

6

Founder Mode (select one):

| 21% | Lack of planning |

| 2% | HR violations |

| 6% | Emotional outbursts |

| 59% | Lack of receptivity to alternative views and facts |

| 12% | Other (be specific) |

7

Manager Mode (select one):

| 17% | Bureaucracy |

| 36% | Lack of urgency |

| 13% | Bloat |

| 28% | Products that underwhelm with incrementalism |

| 6% | Other (be specific) |

8

Do you have optimism that there will be “good” health tech exits (M&A and IPOs) in 2025? (select one)

| 47% | Yes |

| 53% | No |

9

When will we see the first very successful health tech IPO [very successful defined as prices above initial range and stays 20+% above IPO price through lock up release]? (select one)

| 5% | Q2 2025 |

| 13% | Q3 2025 |

| 11% | Q4 2025 |

| 23% | Q1 2026 |

| 19% | Q2 2026 |

| 17% | 2H 2026 |

| 12% | 2027+ |

10

Which subsectors do you think will have the most promising exits? (select up to three)

| 26% | Value-based care |

| 9% | Pharmacy Benefit Managers (PBMs) |

| 22% | Telemedicine / virtual care |

| 8% | Wearables |

| 28% | Genomics and precision medicine |

| 27% | Direct-to-consumer services |

| 10% | Health insurance |

| 60% | Generative AI, analytics, and big data |

| 15% | Digital preventative care programs / wellness |

| 5% | Other (please specify) |

11

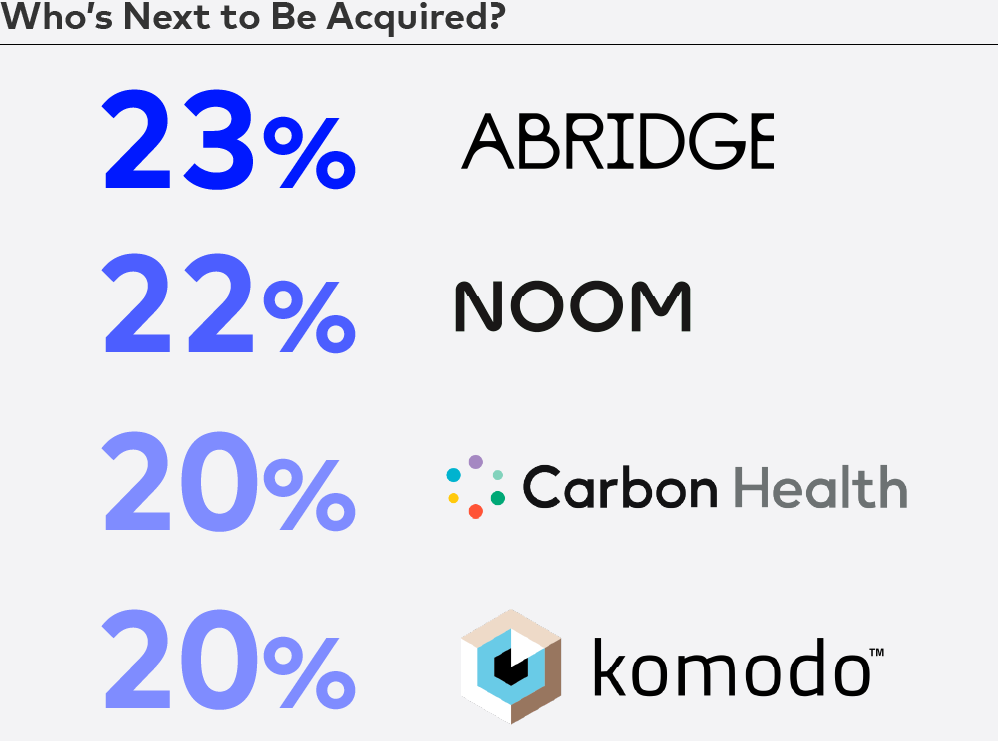

Last year 21% of you correctly predicted Accolade would get acquired and now-shuttered Forward received the least votes… Who’s next to be acquired (excluding Venrock portfolio)? (select up to three)

| 23% | Abridge |

| 7% | Nuna Health |

| 15% | Sword Health |

| 12% | Color |

| 22% | Noom |

| 20% | Komodo Health |

| 15% | Cedar |

| 11% | Spring Health |

| 7% | Modern Health |

| 11% | Somatus |

| 20% | Carbon Health |

| 19% | Omaha Health |

| 15% | Calm |

| 5% | Other (fill-in) |

12

Most promising or exciting new health tech startup (defined as seed or Series A)?

| [open field] |

13

Taking from things RFK, Jr. has said, what’s the craziest shit he will actually do as Secretary of Health and Human Services? (select all that apply)

| 68% | Block, ban, or change guidelines for vaccines |

| 31% | Remove fluoride from U.S. water systems |

| 40% | Ban food dyes and some preservatives |

| 21% | Ban the chemical BPA (lines most baby formula and food cans to prevent foods from chemically reacting with cans) |

| 31% | Legalize the sale of raw milk nationwide |

| 25% | Revoke mifepristone FDA approval |

| 11% | Relocate the CDC to Maryland and CMS to Atlanta to drive employees to quit |

| 26% | Ban or restrict access to medications (antidepressants, antipsychotics, ADHD) |

| 35% | Dismantle the CDC |

14

As a result of the assassination of then-UnitedHealthcare CEO Brian Thompson in December 2024, the private health insurance industry will see a decrease in denied claims in 2025 (2023 had a 12% overall denial rate). (select one)

| 11% | Yes - denied claims will decrease by more than 5% |

| 30% | Yes - but denied claims won’t decrease by more than 4.9% |

| 59% | No - there won’t be any significant changes to the claims approval process |

15

How fast will Medicare Advantage grow (cumulatively) under a Dr. Oz-led Centers for Medicare and Medicaid Services (CMS) over the next 4 years? (select one)

| 59% | Grow by 5-10% [so MA will go from 54% of seniors to 59-64% by EOY 2028] |

| 11% | Grow by >10% [MA will exceed 64% of seniors by EOY 2028] |

| 30% | Stay flat or shrink |

16

By the end of 2025, tariffs will…. (select all that apply)

| 55% | Be wreaking havoc on the markets and foreign relations |

| 56% | Make everything more expensive, especially F-150 trucks, for Americans who just wanted cheaper eggs |

| 31% | Start a full-blown, enduring trade war |

| 9% | Achieve Trump’s stated goal of slowing the illegal drug trade |

| 0% | Trigger a referendum in Canada to become a US State (with Quebec opting out) |

| 29% | Have come and gone |

| 6% | Other (please specify) |

17

Which category best describes your employer? (select one)

| 5% | Academia |

| 1% | Government |

| 25% | Investor |

| 29% | High growth private company / startup |

| 5% | Healthcare provider |

| 5% | Healthcare payor |

| 12% | Life sciences |

| 3% | Professional services |

| 8% | Advisor / consultant |

| 2% | Banking |

| 5% | Other (please specify) |